Blockchain Technology

Blockchain is an indelible electronic ledger which records a series of transactions in real time. Blockchain technology has brought a paradigm shift across all business sectors around the world. Blockchain is catching its base in mainstream industries like banking, retail, healthcare, logistics, and finance. India will soon become a powerhouse in blockchain technology as major stakeholders, as well as medium stakeholders, are leveraging blockchain technology. Gartner research predicts that the blockchain technology will surpass the business revenue US$3 trillion by 2030. As a distributed ledger technology(DLT), blockchain checks security loopholes, accompanies augmented transparency, enhanced efficiency, refined & upgraded traceability, and reduced costs. It reinforces on the blending of AI, IoT and blockchain technology that will explore new business models and generate commendable products for the next generation consumers.

Curbing Black Money

The most powerful features of blockchain technology surmount to be governed by multiple entities as it inhabits a vast network of computers. Hence, technology has no failure issues. With the advancements in scalability, decentralization, and security, blockchain is able to curb black money menaces. The inception of decentralized apps (dApps) has further tightens the digital security issues and provide safeguards to our digital information. dApps is a tight slap for cybercriminals who are stealing our databases from traditionally run applications. IBM has set a major goal to upgrade all its databases into dApps that will augment money management and transfer, business process management, and decentralized autonomous organization.

|

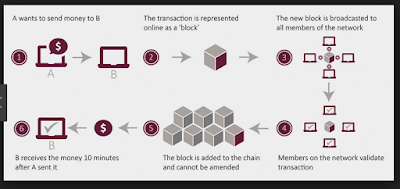

| Working Mechanism of Bloackchain Technology |

Information Security

Cyber hackers send myriads of junk requests to a website which leads to aggrandize the internet traffic. The requests will go on until the site gets overwhelmed with requests and crashes. These type of attacks are termed as Distributed Denial of Service (DDoS) attacks. Big companies like Twitter, Spotify, SoundCloud often experience DDoS attacks. The main difficulty to eradicate DDoS attacks comes from the existing Domain Name System (DNS). DNS is susceptible to hackers as they are able to target the centralized part of DNS and continue crashing of sites one after another.

A functional decentralized DNS system is the only solution to protect our digital information from hackers. Implementation of blockchain technology will distribute the contents to a large number of nodes making it nearly impossible for hackers. Third party access would be very limited and only domain owners have the right to edit the domains. That will enormously alleviate the risk of access by unauthorized parties. Blockstack confers a fully decentralized option for DNS that will eliminate third parties from managing web servers, ID systems, and databases.

Micropayments in India

Micropayment is a monetary transaction that sustains with very low charges per transaction. It accommodates universal computerized wallet that will give you access to transact any website by making a single account.

Crypto-vending machines facilitate the use of digital wallets with relatively low-cost-items and also adhere to the age-restricted items like alcohol. It cornerstones the need of making micro-transactions an everyday occurrence. Blockchain smoothly functions to perform in-store purchases, buying tickets for events, concerts, and sports matches. It embodies our virtual money to make real-life purchases. Leading telecom companies like Jio, Airtel, Vodafone are eyeing for the crypto-vending market in India for day-to-today mobile recharges and transactions. There is a ray of hope that budding startups soon enter into the crypto-vending market in India.

|

| Blockchain and Banking |

Prospects of Digital Payment in India

Remittances are the second largest income for India contributing huge cash flow and development assistance. India is the largest recipient of international remittances with an outstanding amount of US$62.7 billion. International transactions with SWIFT make system sluggish and lethargic as it imbibed various loopholes in the Indian banking system. Blockchain technology is replicated among various nodes in a peer-to-peer network, securing each transaction with a uniquely signed cryptographic private key. This will not lead to inter-party interference in digital payment. Digital token eliminates the need for maintaining debit/credit accounts in varying currencies. It proliferates the liquidity of banks as there are multiple transactions around the world in a given time. The informal and illegal transactions contribute around US$100-200 billion in India. Formalizing even a fraction of the amount will augment the ailing banking sector in India. Ripple, the leading blockchain network in the banking sector, bring down the transaction fee by 43-60 percent through its implementation of diverse blockchain networks. It succors Indian banks save around US$80 million annually.